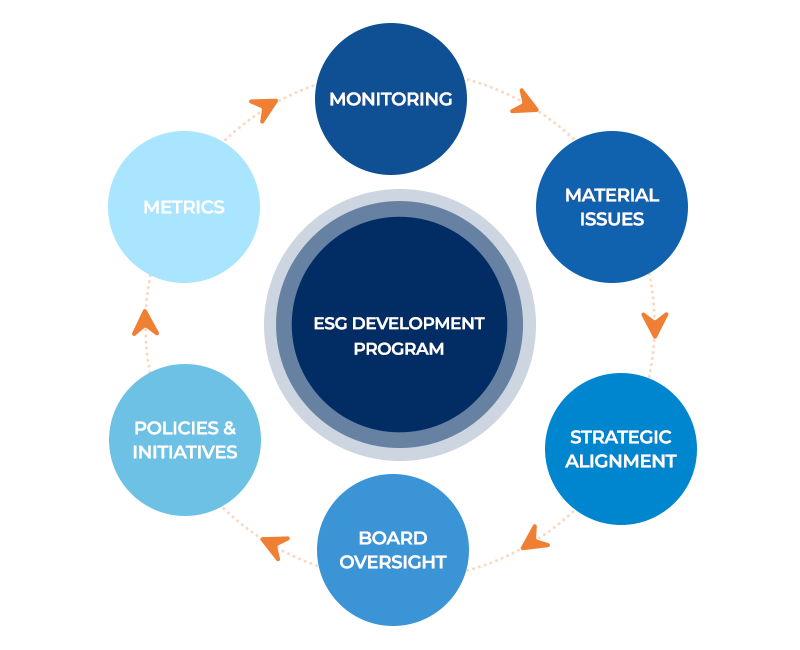

We Help Our Clients Navigate Their Entire ESG Journey

Sustainability and ESG Consulting Services

ESG Strategy Frameworking and Planning

ESG Strategy Frameworking and Planning

Developing a comprehensive strategy and plans to advance ESG efforts in your organization

GHG Emissions

Calculating your organization’s greenhouse gas (GHG) emissions baseline is a key step to creating strategies to reduce emissions and work towards carbon neutral.

Peer Benchmarking

Understanding what your peers are doing in the ESG landscape to help frame your company’s ESG efforts

Data Analysis and Scenario Optimization

Assessing your operations for improvement, understanding the cost benefit of changes, and the timing that maximizes shareholder value.

Sustainability/ESG Reporting

Developing sustainability and ESG reports for your organization using industry standard frameworks such as Sustainability Accounting Standards Board (SASB) and Task Force on Climate Related Financial Disclosures (TCFD).

Disclosure Gap Analysis

Identifying gaps to improve your disclosure material and transparency to stakeholders or investors.

ESG Due Diligence

Conducting due diligence before buying is nothing new but going a step future to collect data and understand the ESG impact is critical now

GHG Dashboarding

Understanding where your GHG emissions are trending more frequently than the yearly reporting requirements provides companies the ability to strategically improve and communicate more often with stakeholders

ESG Assurance and Auditing

Increasing calls for assurance of reported ESG information by investors, the public, and stakeholders might necessitate an independent third-party review